Communities throughout the United States face limited housing options and surging demand for affordable units. Decades of under producing new housing, combined with strong economic growth, has amplified the affordable housing crisis.

More municipalities and state governments have been driven to consider implementing measures such as rent control designed to combat higher housing costs and to offset job and income losses stemming from the COVID-19 pandemic.

While urban coastal markets, including California and New York, have implemented or enhanced rent control measures in recent years, local government and grassroots efforts are pushing for rent control and other restrictions, including eviction constraints, even in areas generally considered affordable.

The COVID-19 pandemic has heightened concerns around housing accessibility and affordability, and a number of rent control-related measures will appear on state and local ballots in November 2020.

As the economic shutdowns and ensuing downturn strain household finances throughout the income spectrum, calls for renter protection ordinances are growing across the country.

Below, we explore the impact expanded rent control could have on the real estate market and important issues for your business to keep front of mind.

Unintended Consequences of Rent Control

While rent control advocates hope that lower income households will benefit from lower-cost housing, the market distortions caused by capping prices can cause unintended consequences, including reducing construction, hastening the deterioration of housing stock and reducing mobility.

Lack of New Housing

While many factors can contribute to building an adequate new housing supply, rent control laws can exacerbate housing affordability issues by reducing the supply of rental housing. Reducing the income potential can alter the highest and best use of an investment asset. Over time, owners of rental apartments may convert existing buildings to other real estate types.

Similarly, when redevelopment or greenfield site developments materialize, development capital may not be available or the potential income stream of rental apartments under rent control may not justify more development.

Varying Owner Incentives

Some investors may be incentivized to leave units vacant or, in the case of individual owners, move into units themselves rather than leasing to rent-controlled tenants, further constraining the supply of available apartment units.

While current rent control laws under consideration may vary from earlier counterparts, several studies on rent control from the 1970s to 2000s highlighted the reduction in rent-controlled units in the years following enactment of legislation. Studies in cities from Boston to New York to San Francisco found that many apartment owners converted or left vacant thousands of apartment units.

Access for Lower Income Households

Although rent control is intended to benefit lower income households, it could unintentionally make accessing quality housing more difficult. Currently, states and municipalities with rent control don’t require any type of income qualification.

Without means testing of renter households, higher income households can, and often do, reside in rent-controlled units. While rent control reduces housing costs for some lower income households, the benefit of lower costs of living often accrue disproportionally to higher income households with the means and ability to secure rent-controlled apartment units. By reducing the number of available rental units and increasing competition among households of all income levels, many lower income households that most need assistance are unable to access units.

For households in rent-controlled units, there’s substantial benefit to remaining within the unit even if it’s no longer optimal for their situation or their income rises and makes subsidizing living expenses unnecessary.

With households incentivized to remain in units longer than necessary, fewer housing units are available to lower income households that would deservingly benefit from lower expenses.

Reduced Investor Incentives and Construction

The expansion of rent control to newly constructed properties, or as seen recently, a rolling basis of 15 years following construction, can substantially impact the financial feasibility of development. If construction costs continue to escalate, but income streams are capped, many apartment developments simply wouldn’t make financial sense.

By eliminating the upside to an investment opportunity, developers, investment capital groups, and lenders could be unwilling to proceed, constraining new apartment supply. In the current environment, where costs of development are high, reducing potential future income by even a few percentage points could be enough to scrap projects.

Should underwriting standards shift with bank lending capacity constrained due to pandemic-related consumer and business loan losses, the reduced financial incentives under rent control regimes could curtail development activity further.

Reduced Property Values

In addition to the negative effects of rent control on construction activity, diminished rental income results in additional unintended consequences that can lead to a drop in property values.

On average, operating expenses can account for between 35% and 50% of gross income of a property. General inflation trends, as well as additional expenses as a building ages, increase these costs over time. Under rent control, rental income may not keep pace with increases in property expenses.

The reduction in rental income, or expected growth over time in rents, directly translate to lower net income and reduce the market value of a property. Even small differences in rent growth can accumulate over time, particularly for owners with longer term holding cycles, and can lead to large decreases in the value of the property relative to noncontrolled properties.

Impact on Local Governments

Another potentially significant consequence of rent control could be a decline in state and local tax revenue from property taxes and transfer taxes at a time when government budgets have been decimated by the COVID-19 pandemic.

While economic downturns tend to reduce revenue and increase expenditures for social services and other programs, the unprecedented public sector response to COVID-19 has stressed municipal finances across the country. A long-term decline in property values could reduce future tax revenue in good times and bad.

With property values lower than anticipated, a reduction in potential investors could reduce the number of transactions. Properties that do transact could do so at reduced values. Both outcomes would lead to reduced tax revenue as was exhibited in the first and second quarters of 2020 as economic shutdowns and uncertainty halted most transactions.

Less tax dollars could lead to reduced services, school funding, and safety services, all of which can further negatively impact the value of real estate.

Rent Control Forecast

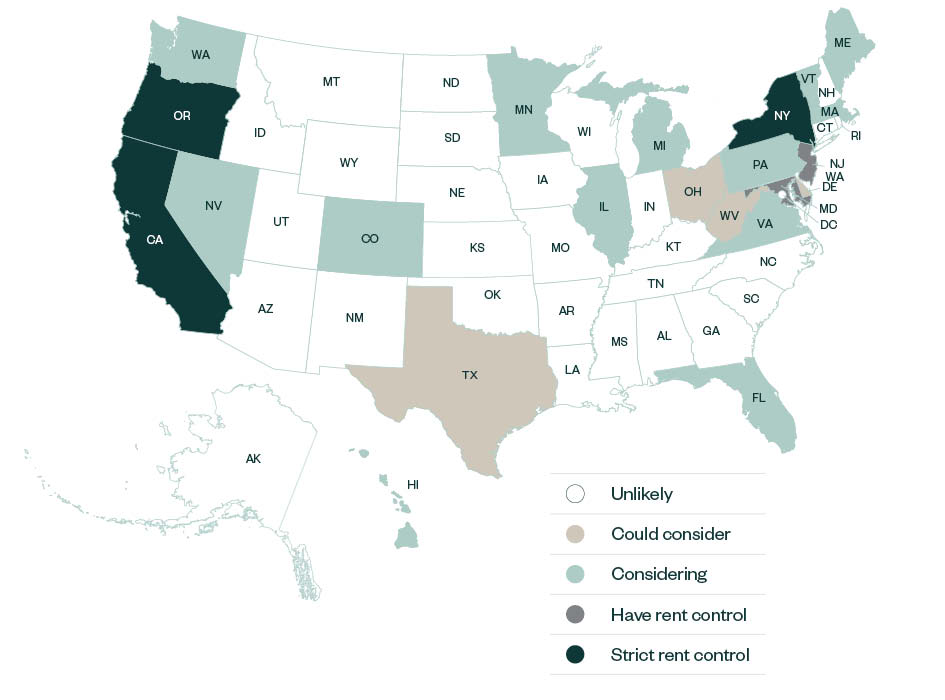

Currently, five states and the District of Columbia have some form of rent control. California, Oregon, and New York introduced or significantly enhanced rent control restrictions within the last year.

Additionally, COVID-19 pandemic-related federal, state, and local eviction moratoriums were enacted throughout the country and could be extended further as the pandemic persists.

Notable State Activity

Oregon was the first state to introduce statewide rent control in 2019. The Oregon law restricts annual rent increases to 7% plus the rate of local inflation on apartments built more than 15 years ago and provides tenant protection measures.

In California, the legislature and governor enacted a statewide rent control law that caps rent increases at 5%, plus the rate of inflation, and leaves intact local rent control ordinances allowed prior to the implementation of Costa-Hawkins in 1995.

The vast majority of California’s approximately three million apartment units would generally fall under the rent control law. The Oregon and California laws also regulate allowable eviction reasons and require relocation payments for certain types of evictions. Both Oregon and California allow for vacancy decontrol, making both of these statutes act as moderate forms of rent control.

In New York, although cases are still proceeding through the legal system, lawmakers tightened what was already the most severe form of rent control in the country. Recent enhancements include eliminating vacancy decontrol and capping pass-throughs of capital improvement costs on top of limiting allowable rent increases.

Rent Growth

Since 2003, the average annual rent growth in California was just 0.9%, including several periods during the Great Recession when apartment rents declined. During this period, the average rent growth exceeded the potential rent cap nine times, all within the 2014 to 2015 period when the apartment market boomed, much of the new construction had yet to come online, and consumer price index remained low.

Also, since 2004, the average rent growth didn’t exceed 10%. Similarly, in Oregon, the average rent growth rarely exceeded the potential rent cap. Since 2010, the average rent growth exceeded the rent cap in only three quarters. These were also in the 2014 to 2015 period. The average rent growth since 2010 was 4.8%.

Rent control measures in California and Oregon didn’t pass when apartment rents were increasing at a substantial pace, but years after peak rent growth and rent increases had returned to normal ranges. Other states may continue to explore implementation of rent control even during times when annual apartment rent growth is within historical norms.

Future State Activity

California and New York tend to lead the country on legislative trends, and rent control is proving no different. While many states explicitly outlaw rent control, a growing movement for greater housing affordability is pressuring local and state officials across the country to reconsider.

Efforts were underway early in 2020 in several states to overturn laws preventing or restricting rent control, notably in Illinois and Florida. While some regions are unlikely to seriously consider strict rent control, even in these states urban affordable housing advocates and some local government officials are exploring ways to enhance tenant rights, including expanding eviction protections.

Additionally, the unprecedented job losses and economic shutdowns during the COVID-19 pandemic are driving many local officials to support rent control.

As many as 18 states have or are currently considering some form of rent control or assistance for renters beyond the COVID-19 related measures. As housing affordability issues increase, expect more state and local governments to consider rent control measures.

Implications and Alternatives to Evaluate

Rent control policies can effectively limit the potential income stream from an apartment investment property and decrease the potential return over time. In instances where future income is capped, asset values may adjust accordingly and investors will adjust allocations and interest in the sector.

The eventual impact of rent control on investment levels and asset values is contingent upon the severity of the rent control law. Highlighting differing trends in states that enacted rent control recently provides an estimate of how rent control could impact apartment investment trends in other states considering rent control laws.

Reduced Investment Activities

The rent caps in Oregon and California aren’t draconian in nature, allowing most investors to continue to collect income streams in line with projections. This has allowed the states’ investment markets to operate at somewhat normal levels despite the withdrawal of some investors.

In New York, the more severe restrictions have impacted investor behavior. The pool of buyers for some apartment assets, in particular older buildings, has thinned substantially. In the second quarter of 2019, following passage of the recent laws, apartment investment volume throughout the state fell by one-third.

When California voters evaluated Proposition 10 in 2018, the ballot measure to repeal Costa-Hawkins, the nonpartisan Legislative Analyst’s Office concluded, “the value of rental housing would decline because potential landlords would not want to pay as much for these properties.”

A Massachusetts Institute of Technology study found that the value of homes in Cambridge declined while under rent control and surged by up to 25% in the years after rent control was lifted.

Declining Unit Value

Similarly, a University of California, Berkeley study from the 1990s found that the value of rental units declined by 15% while under rent control compared with surrounding municipalities where rent control wasn’t implemented and housing values doubled during the same period.

Based on previous academic studies, as well as analysis of the type of rent control recently introduced or considered, the potential decline in value of properties subject to aggressive rent control could be between 10% and 35%.

If implemented policies were more severe, including vacancy control for example, the potential value loss would be even greater. The decline in asset value would hurt current investors and alter investment return expectations and investment behavior on future acquisitions.

In New York, expectations for future value of assets has fallen, though the exact amount remains unclear as buyers and sellers await regulatory clarification and several lawsuits winding their way through the courts that could ultimately determine the applicability of the rent control laws.

The expected decline in the value of apartment properties would depend upon several factors, including the severity of implemented rent control. The maximum allowable rent increase, as well as the ability to pass-through a portion of expenses from capital expenditures, impacts potential rental income.

Vacancy Control

Vacancy control, whereby rents aren’t allowed to reset when a unit is vacated, perhaps is the most harmful component of rent control regulations. Under vacancy control, government by default dictates the maximum potential income of each unit, and subsequently imposes a ceiling on the value of the unit. Therefore, vacancy control in particular can ultimately erode the value of apartment properties over time.

Whether considering the decrease in gross revenue potential or a decline in asset values, rent control negatively impacts investment in apartments. Driving some investors out of the market may not have much impact in the near term, but can reduce liquidity long term.

As seen in previous cycles, a lack of liquidity in the real estate market can cause substantial asset value declines and generally increase investor risk. The rising risk of rent control in many markets across the country is a potential sea change for apartment investors. They could face unexpected reductions in asset values which underscores the vital importance of due diligence and investment strategy.

Plan for Your Future

Current and future legislative changes can affect property valuations, so it’s important to monitor and consider the specifics of the states your business operates in when making investment decisions.

Changes in legislation can also impact investment returns and the long-term viability of a community. Education and a proactive real estate community surrounding the short and long-term impacts of rent control is critical to the future of housing.

Real estate investors and developers should take a pro-active approach to confronting rent control by conducting strategic reviews of their portfolios and objectives. This can help determine how changes to existing, and new regulations, might impact your business and what options may be available to move forward.